Chinese vendors bookend 5G RAN market: GlobalData

As 5G rollouts begin to pick up subscribers around the world, analyst firm GlobalData has concluded that Huawei is leading the pack of vendors supplying 5G radios to telcos.

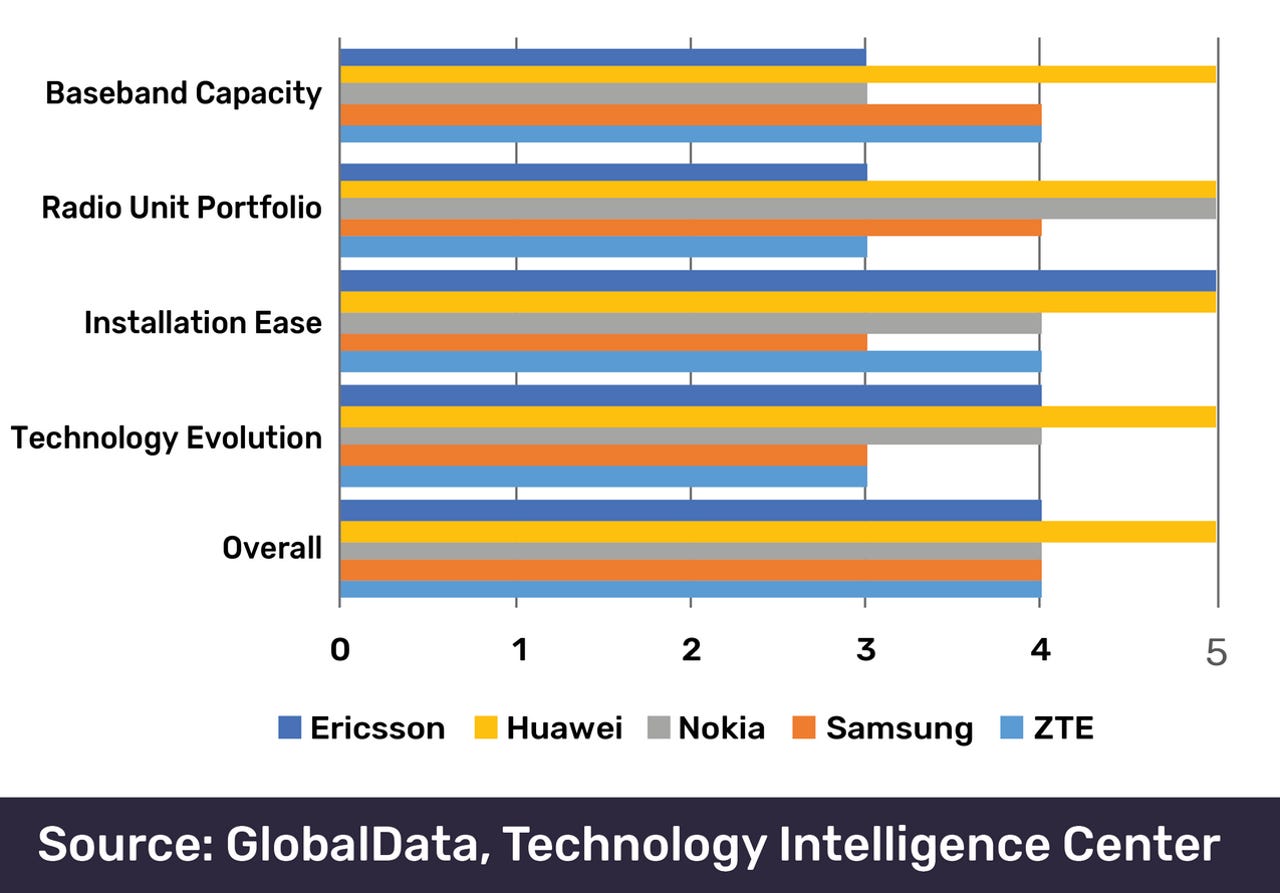

Of the five equipment makers looked at -- Huawei, Ericsson, Nokia, ZTE, and Samsung -- the Chinese giant was the only contender to get a perfect score across the categories of baseband capacity, radio unit portfolio, ease of installation, and technology evolution.

"The 5G RAN market is extremely competitive in these early stages," said Ed Gubbins, principal analyst at GlobalData.

"Operators' decisions today will direct the next decade of global telecom investment and ultimately usher in fundamental changes to the way we live and work in the 5G era."

Beyond Huawei, GlobalData said Ericsson excelled in ease of installation, while Nokia's range and compact radios was its strongest suit.

Both ZTE and Samsung were unable to gain a full mark from GlobalData, but were handed the same overall score as Ericsson and Nokia.

Also see: The winner in the war on Huawei is Samsung

Gubbins added that while 5G remains reliant in a 4G core, known as non-standalone 5G, telcos will stick to vendors they already use.

"Standalone 5G, which requires a 5G core, will give vendors a better chance to penetrate new operator accounts and grow their global market share," Gubbins added.

"We expect the standalone 5G RAN market to start ramping up in 2020."

In a recent report, ratings agency S&P questioned whether Huawei's claimed leadership on 5G would matter.

"Even if Huawei was initially in the lead, we think European and Asian vendors are catching up, and we are therefore cautious about the extent to which Huawei may have a material product or cost advantage," the report said.

"If reports of a 5G gap are true, operators in markets facing Huawei restrictions could theoretically see higher equipment spending or delays in 5G implementation. But given the lack of value-added, 5G-ready use case applications, our forecast for 5G investment and customer appetite is bearish, so any incremental increase cost or delay should be nonmaterial to the ratings."

This week, a poll from the Lowy Institute showed Australians were divided between wanting Chinese technology and fearing China.

The Institute added that Australians backed Canberra's decision to ban Huawei and ZTE from the nation's 5G networks. Huawei is also currently banned from being used in the National Broadband Network (NBN).

Read: Huawei ramps up its technological Cold War propaganda

On Tuesday, Huawei complained that Ericsson had been able to escape scutiny for its part in Australia's NBN fixed wireless rollout.

The Australian arm of the Chinese giant said the NBN had failed and put forward the use of 5G fixed wireless as a solution.

NBN and Ericsson began 5G trials in April last year.

Related Coverage

- Australians fear China but want its technology: Lowy Institute poll

- Huawei shipped 100 million handsets by May 30

- S&P warns Huawei ban will hit US tech long-term

- Huawei's laptop division cancelling orders amid rumors of exiting PC market (TechRepublic)

- Huawei's "plan B" smartphone OS: What it needs to succeed (TechRepublic)