Dell Q3 mixed as server, networking sales slide

Dell Technologies' third quarter revenue was lighter than expected, but the company's earnings topped expectations.

The company reported third quarter net income of $552 million, or 66 cents a share, on revenue of $22.8 billion, up 1% from a year ago. Non-GAAP earnings were $1.75 a share.

Dell Technologies was expected to deliver third quarter non-GAAP earnings of $1.62 a share on revenue of $23.04 billion.

According to the company, the client solutions unit delivered third quarter revenue of $11.4 billion, up 5% from a year ago, with operating income of $739 million. Commercial revenue was up 9% from a year ago with consumer sales down 6%.

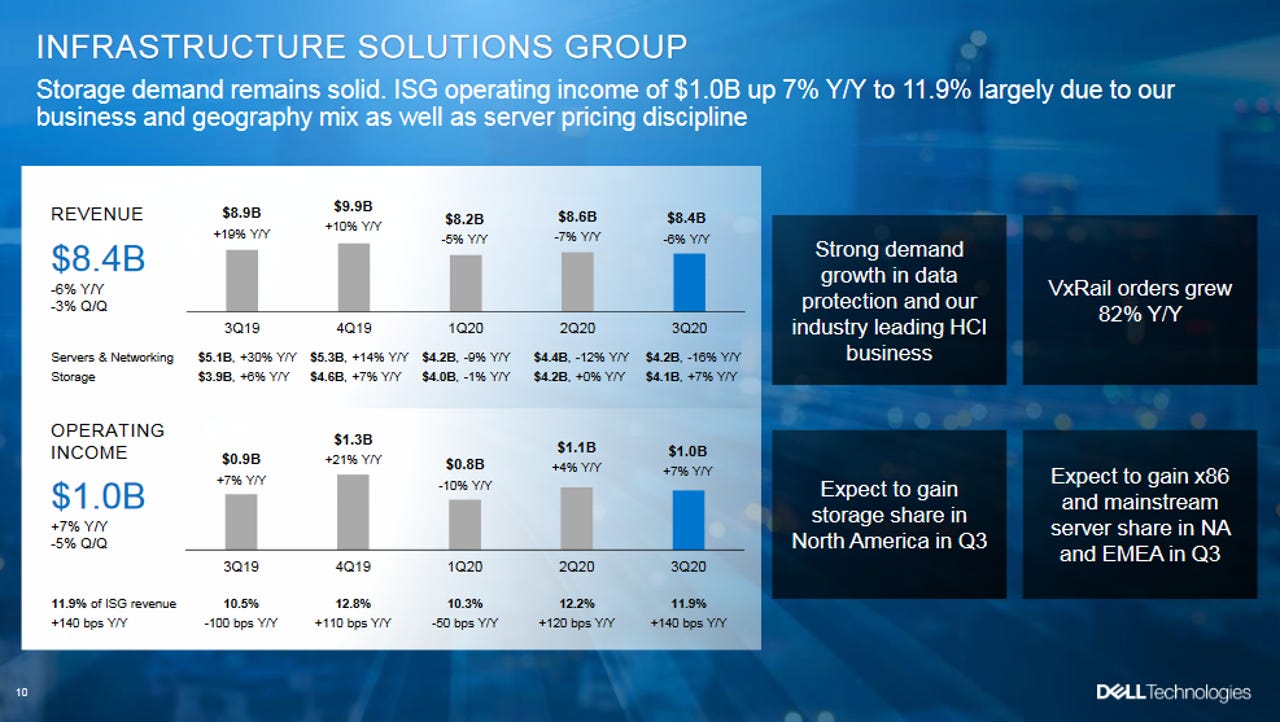

Dell Technologies' revenue shortfall was largely due to its data center unit. The infrastructure solutions group delivered third quarter revenue of $8.4 billion, down 6% from a year ago. Servers and networking sales fell 16%, but Dell Technologies did see storage revenue jump 7%. Operating income was $1 billion. Dell Technologies makes VMware linchpin of hybrid cloud, data center as a service, end user strategies

The company noted that its goal is to increase share in a consolidating industry. Dell Technologies' ace is VMware, which delivered a solid third quarter and spins off cash to its parent.

Jeffrey Clarke, Dell's vice chairman of product and operations, said on conference call:

From a customer set and geographic perspective, we see solid demand in small, medium and commercial accounts with weakness in China and some softening in the large enterprise space. From a business unit perspective, we see softness in infrastructure solutions demand driven by servers, while client solutions and VMware are solid. Let me share a few examples. Our storage

business grew 7%. We saw strong Q3 demand in data protection and hyperconverged with VXRail orders up 82%.We expect to gain storage share in North America and [Canada] in Q3. More importantly, our customers and sales teams are optimistic about our portfolio and positioning. The server demand environment remains challenged as many customers continue to digest last year's unprecedented growth.

For the PC business, Clarke said demand "remains healthy" courtesy of the Windows 10 refresh cycle.

More: