NBN equity to cost government cash balance AU$2.1b annually by 2027

The equity put into the company responsible for deploying the National Broadband Network across Australia will result in an annual AU$2.1 billion drag on the federal government's underlying cash balance by 2026-27, the Parliament Budget Office (PBO) has said.

PBO said the cost was entirely due to interest payments on the securities issued by the government as part of its debt issuing practices.

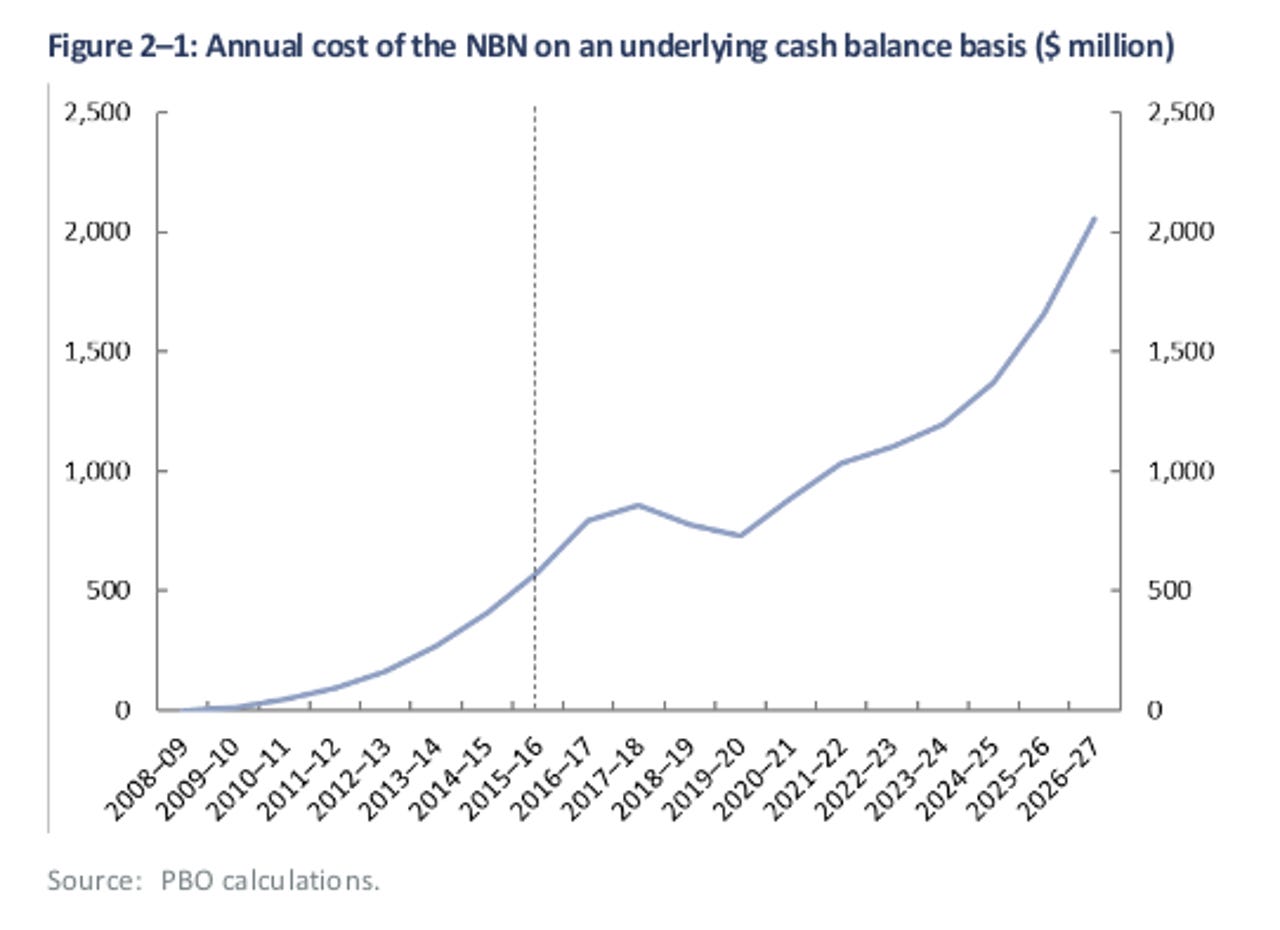

For 2015-16, the cost sat at AU$580 million, with a jump to AU$730 million expected by 2019-20, and the cost to reach AU$2.1 billion by 2026-27.

The Australian government has AU$29.5 billion in NBN equity, and last month handed NBN a AU$19.5 billion loan that is expected to be repaid to the government through external financing by 2020-21.

Latest Australian news

As the loan to the government is repaid, it would partially offset the cost of the government borrowings for equity, PBO said.

"There is currently no publicly available information on when NBN Co is projected to start paying dividends to the Commonwealth," PBO said. "If NBN Co pays dividends in the future, the dividend receipts would have a positive impact on the underlying cash balance."

PBO said the government's investment in NBN has resulted in the Commonwealth losing almost AU$8.8 billion in net worth.

"This deterioration in the Commonwealth's balance sheet reflects the net impact of the accumulated losses and asset revaluations on NBN Co's fair value, the accumulated cost to the Commonwealth of the [public debt interest] payments on the borrowings to support the Commonwealth's equity and debt contributions to NBN Co, and any interest receipts from NBN Co," PBO stated.

PBO said there is a risk that NBN would be unable to refinance its loan at an acceptable rate, and if that happens, interest payment would continue to offset the hit to the cash bottom line.

NBN CEO Bill Morrow said in November the loan would allow the company to focus solely on its network rollout, and was in the best interest of the Australian tax payer.

Earlier this week, the government released draft legislation that would see users of fixed-line broadband capable of more than 25Mbps hit with a AU$7 monthly charge, to be contributed to a Regional Broadband Scheme to fund fixed wireless and satellite services in regional Australia.

The monthly charge would replace NBN's internal cross-sudsidy where urban users pay more to fund regional connectivity.

"The [existing] provisions have not succeeded, as network providers have expanded into population dense areas with existing infrastructure beyond what was originally conceived through the grandfathering provisions," the Department of Communications said on Monday.

"As currently structured, NBN is at a competitive disadvantage to comparable providers that do not face similar costs of providing fixed wireless and satellite broadband services."

Set to start next financial year, the initial AU$7.10 per month charge will raise AU$370 million from NBN, and AU$40 million from other broadband providers.

The levy will not apply to fixed wireless, satellite, exchange-based DSL, inactive broadband services, or to lines set to transfer to NBN under agreements signed with Telstra and Optus.

During consultations, the department said NBN suggested that mobile broadband users contribute to the scheme, while TPG said it may offer services via fixed wireless to avoid the charge.