Oracle touts growing subscription revenues in Q3

Oracle posted third quarter financial results slightly above expectations Thursday, emphasizing its steady, incremental growth in subscription revenues.

Oracle's momentum in subscription sales "would've been even more obvious [in Q3] but for the early impact of the virus," Oracle CEO Safra Catz said on a Thursday conference call, referring to the COVID-19 coronavirus outbreak.

Oracle is, so far, "largely conducting business as usual with some modifications" in response to the outbreak, Catz said. Those modifications include more reliance on videoconferencing and asking employees to postpone non-essential travel. It's "not yet clear what effect the virus will have on customer and suppliers and, as a result, what it will be on Q4," she said.

Subscription revenue should see minimal impact from the outbreak, given much of that revenue is already contracted, the CEO said.

"In June, assuming the global economic situation has stabilized, we'll share with you the basis for my optimism around our revenue growth acceleration for FY 2021," Catz said. "It will be based on the ever-growing portion of our revenue attributable to our faster-growing subscription business."

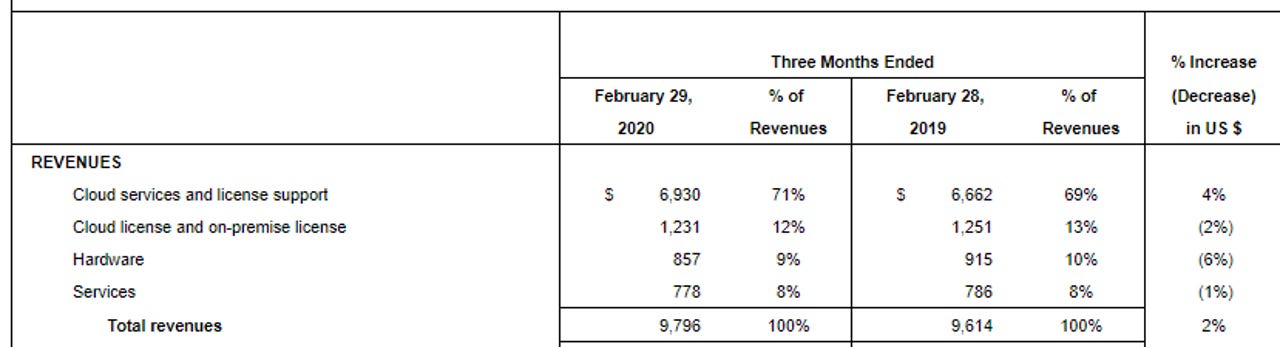

Oracle's non-GAAP net income for the quarter was $3.2 billion, or 97 cents per share, on revenue of $9.8 billion, up 2 percent year-over-year.

Wall Street was looking for earnings of 96 cents per share on revenue of $9.75 billion.

Subscription revenues -- which includes sales from Cloud Services and License Support -- were $6.9 billion, up 4 percent year-over-year. Cloud License and On-Premise License revenues came to $1.2 billion.

In a statement, Catz said the company had an "extremely strong quarter," zeroing in on subscription revenues.

"These consistently growing and recurring subscription revenues now account for 71% of total company revenues, thus enabling a sequential increase in our operating margin, and double-digit non-GAAP Earnings Per Share growth in Q3," Catz said.

Oracle also announced its board of directors increased the authorization for share repurchases by $15 billion. Additionally, the board of directors declared a quarterly cash dividend of 24 cents per share of outstanding common stock.

Oracle touted the growth of its cloud ERP businesses: Oracle's Fusion ERP cloud revenues were up 37 percent year-over-year in Q3. NetSuite ERP was up 26 percent. Oracle currently has more than 7,000 Fusion ERP customers and 21,000 NetSuite ERP customers.

Meanwhile, Orace founder and CTO Larry Ellison said in a statement that "thousands of customers are now using the revolutionary new Oracle Autonomous Database in our Generation 2 Public Cloud." In the prior quarter, Ellison similarly said that "thousands" of customers were using the Autonomous Database.

Autonomous Database revenues were up over 150 percent for the quarter, Catz said.

Ellison repeated his previous assertion that Autonomous Database infrastructure and cloud ERP applications are the " two key product areas that will determine Oracle's future."

He added, "Being No. 1 in both of these two giant market segments will enable the success of our other application and infrastructure products in adjacent market segments. We expect the cloud ERP market segment to be two to three times larger than the prior on-premise ERP software market."

Catz gave a wide range for Oracle's Q4 outlook, due to the current economic uncertainty. Total revenues are expected to range between negative 2 percent to positive 2 percent. Total subscription revenues for Q4 are expected to range between 3 percent to 5 percent. Non-GAAP EPS is expected to grow between 3 percent to 9 percent and be between $1.20 and $1.28.