PC sales continue to take a beating

PC OEMs are hoping that Terry Myerson, the head of Microsoft's Operating Systems Group, wasn't making an idle boast when he said Windows 10 would be on a billion devices in two to three years. That's because by research house Canalys's reckoning, "The global PC market, including tablets, experienced an annual decline of 7 percent in Q1 2015."

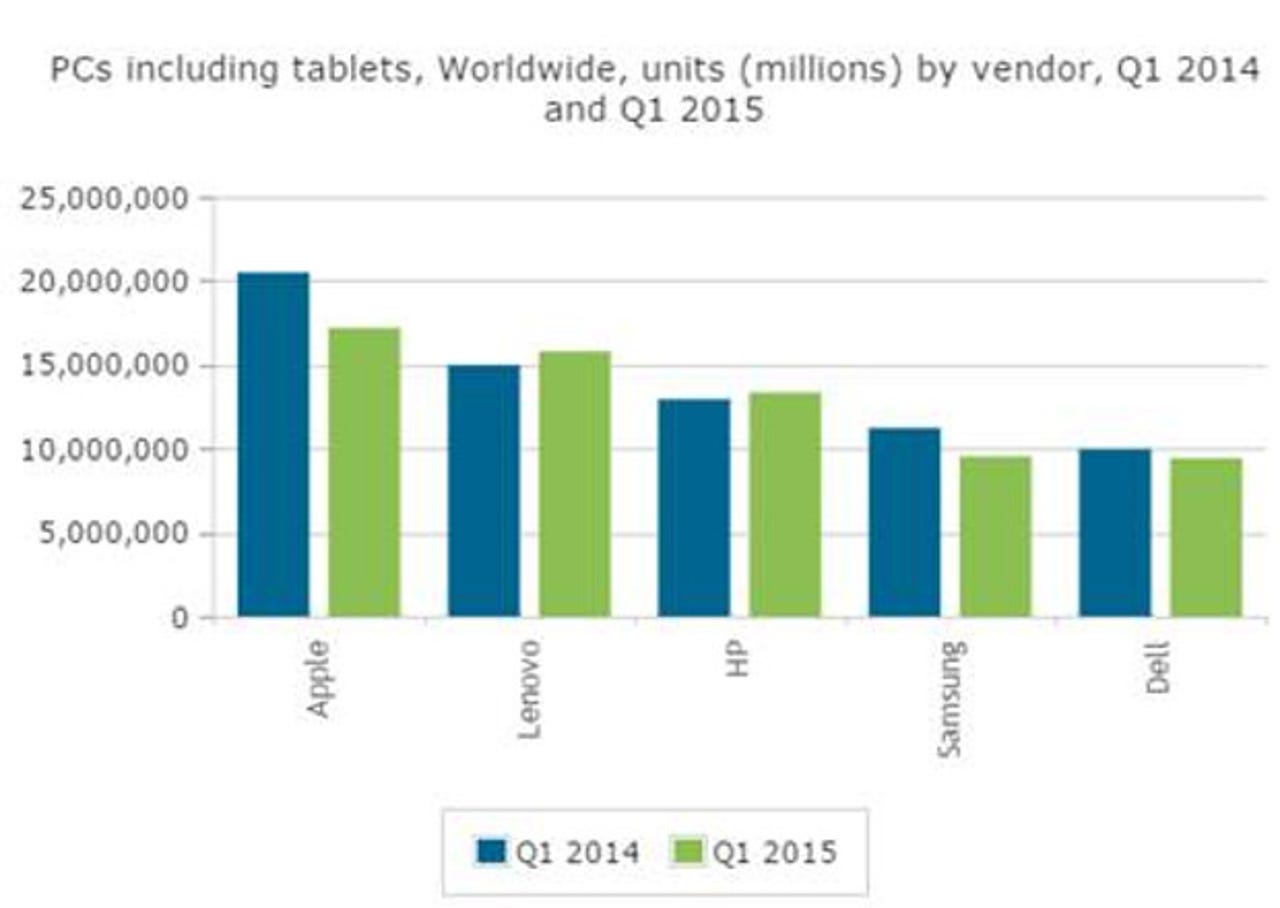

Canalys found Apple still holding on to first place despite a 16 percent decline in its total PC shipments. The iPhone giant shipped 17.2 million units, taking first place of the shrinking market with a 15 percent share. Lenovo and HP took second and third place respectively. Both saw single-digit shipment growth in Q1 2015 and increases in market share. Samsung narrowly held on to fourth spot as its declining tablet sales led to Dell closing the gap in fifth place. Samsung and Dell took the final two spots with a combined 8.2 percent shipment market share with 9.5 and 9.4 million units respectively.

Desktop shipments were hardest hit, falling 13 percent, with declines affecting all global regions. "The desktop category no longer benefits from shipments driven by XP migration," said Rushabh Doshi, a Canalys analyst in a statement. "As a result, we expect to see significant shipment declines in 2015 when compared to 2014."

Tim Coulling, Canalys senior analyst, said in a press release that part of this decline is because "The growth drivers that previously helped the market through 2014 will have little effect this year." Coulling also expects PC demand to soften as "Windows 10 draws nearer along with Microsoft's free upgrade plans."

Looking for a silver-lining, Canalys noted that the notebook hadn't declined quite as badly. Even so it dropped 4 percent. "The notebook category faces significant challenges for the rest of the year as Microsoft has restricted the Windows with Bing program to notebooks with sub 14-inch screen sizes. Channel inventory has been building since Microsoft announced the change and this will need to adjust before significant orders return," Doshi observed.

Tech Pro Research

Doshi also said that "Any price rises for Windows notebooks will play into the hands of Google who is making strides in improving Chrome OS for both consumers and businesses." As ZDNet's own James Kendrick said, "We should see the adoption of Chromebooks continue to grow in 2015, as current owners and organizations using them spread the word. Low prices will make the decision to buy the Chromebook just as attractive next year as it did in 2014."

As for tablets in particular, Canalys saw the tablet market declining by about 9 percent year-on-year. Even market leaders Samsung and Apple experienced double-digit shipment declines as tablet demand has cooled. IDC agrees. It found in February that the last quarter of 2014 saw worldwide tablet shipments recorded a year-over-year decline for the first time since the market's inception in 2010.

This is because, Coulling stated, "The rapid growth in the tablet market has caused markets in Western Europe and North America to become highly penetrated and shipment volumes have started to decline. Growth in these markets now relies on consumer replacements or increasing business purchases, neither of which looks likely to pick up significantly in the coming quarters."

The one bright spot, if you can call it that, is the tiny hybrid and convertible shipments doubled year-over-year in Q1 2015, reaching 3.0 million units. Asus headed the market with 28 percent market share, followed by Lenovo and Acer with 19 percent.

So it is that if the PC market is to ever regain traction, Windows 10 must be a hit. If it's not, it's going to be a long, slow painful decline for PC OEMs.

Related Stories: