Yahoo's Q2 mixed bag, outlook disappoints amid salesforce turnover

Yahoo's second quarter presented a very mixed picture of the company. The outlook didn't provide much clarity on the company's growth prospects either.

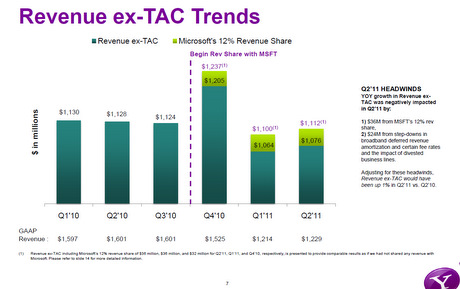

Yahoo reported second quarter earnings of $237 million, or 18 cents a share (statement). Non-GAAP earnings were 19 cents a share on a revenue of $1.076 billion. Wall Street was expecting Yahoo to report second quarter earnings of 18 cents a share on revenue of $1.1 billion.

While those numbers are slightly off from Wall Street expectations, Yahoo does tout some improvements from a year ago. For example, income from operations increased by nine percent to $191 million during the second quarter of 2011, compared to $175 million during the second quarter of 2010.

Yahoo's CEO Carol Bartz explained a statement:

For the quarter, earnings per share was up by 18% year over year. We made clear progress in search, and saw strong growth in engagement on our media properties.

We experienced softness in display revenue in the second half of the quarter due to comprehensive changes we have made in our sales organization to position ourselves for more rapid display growth in the future.

On a conference call, Bartz struggled a bit. She said:

Our results in Q2 were a mix of good, encouraging, and at the same time unsatisfactory. First with good. Expenses were welling managed, profits were up, and we bought back a lot of stock. We're making clear measurable progress in Search and we have continued to accelerate the launch of sites on our new publishing platform.

But Bartz said negotiations with Alipay on a graceful exit are still going on. The display business also struggled as a big chunk of the salesforce walked. She said:

Overall display revenue ex-TAC was up 5%. Display in EMEA was up 27% and Asia-Pacific up 20%. However, the America as region was flat with U.S. display down unexpectedly. Obviously I am not happy about our performance. Let me tell you what happened, why it happened and what we're going to do to fix the problem and re-accelerate display growth. In the first half of Q2 display revenue in the US was pretty much consistent with our expectations. As the quarter progressed we saw increasing softness, especially in June. Let me be clear what this was not. This miss was not about new competitive developments. It was not about the economy although the economy didn't help as we saw softness in the CPG, Auto, and Retail categories. Finally, it was not about engagement which grew nicely in Q2. The root cause is the comprehensive changes we discussed with you at our Investor Day, changes to our U.S. sales leadership which led to changes to our sales org structure and then to changes in our sales force. In May we made a decision to reorganize the U.S. field organization into and to move aggressively to position ourselves for more rapid display growth in the future. However, the combined short-term result was significant turnover in our field sales. That is the actual feet on the street. Turnover accelerated as all of these changes affected the sales organization.

Yahoo's results reflect $55 million in search operating cost reimbursements and $12 million in transition cost reimbursements from Microsoft under the Search Agreement. But Yahoo insists that search operating cost reimbursements will decline as Yahoo continues to transition all markets to Microsoft’s search platform.

Additionally, Yahoo continues to play up its sought-after-status as a digital media hub, boasting that it has "nine out of the top ten original video programs on the Web," including In the Dressing Room, which became the second most popular program on Yahoo News.

For the outlook, Yahoo is predicting a revenue of $1.05 billion to $1.1 billion by the end of the third quarter of 2011.

For the third quarter of fiscal 2011, Wall Street is expecting Yahoo to report more of the same---earnings of 19 cents a share on revenue of $1.12 billion.

Key points:

- Launched a new "faster, safer and easier" version of Yahoo Mail

- Introduced Yahoo! App Search for the PC and Yahoo! AppSpot for mobile phones

- Yahoo teamed with Benchmark Capital to form Hortonworks for Apache Hadoop

- Acquired IntoNow and 5to1 online advertising alliance

By the numbers:

- Yahoo is home to nine of the top properties globally in the top three in 23 categories

- Cash flow from operating activities was $331 million in Q2 2011

- Free cash flow was $96 million in Q2 2011, which is down 25 percent from Q2 2010

- Yahoo repurchased $472 million worth of stock

Related:

- Bartz and a tale of two Yahoos

- Yahoo Mail integrates Facebook, Twitter in overhaul; can it compete with Gmail?

- Yahoo’s Search Direct: Evidence that its internal cloud starting to pay off

- Bing surpasses Yahoo! as second most popular search engine worldwide

- Yahoo wants to take over your TV, launches 30 new apps