Adobe's Document Cloud gunning for DocuSign, digital workflows

Adobe's fiscal 2020 Document Cloud revenue is on par with DocuSign as both aim to be go-to software providers for digitizing document management.

The mutual ambitions between Adobe and DocuSign were evident on Adobe's fourth quarter earnings report and investor day. Adobe executives mentioned document management 47 times during the company's investor day. For perspective, Adobe mentioned Creative Cloud 91 times and digital experiences 109 times.

Certainly, Adobe has a little different spin than DocuSign. Adobe is using its PDF and Acrobat franchise to layer in e-signature and workflow services. DocuSign is the leading e-signature company and has its own Agreement Cloud.

The revenue for the Adobe Document Cloud and DocuSign line up pretty closely. For fiscal 2020, Adobe reported Document Cloud revenue of $1.5 billion with sales of $411 million in the fourth quarter, up 21% from a year ago. DocuSign is expected to report annual revenue for the year ending Jan. 31, 2021 of $1.42 billion with fourth quarter revenue of $407.6 million.

Overall, I'd put DocuSign more in the digital workflow category as it digitizes corporate functions such as legal and HR and has a bevy of key integrations. Adobe sees its Document Cloud as a pillar to its growth strategy but isn't as embedded in corporate functions with the exception of marketing and creative workflows.

But the collision course is set.

Adobe is aiming to hit the same themes as DocuSign from a different angle. Adobe CEO Shantanu Narayen said:

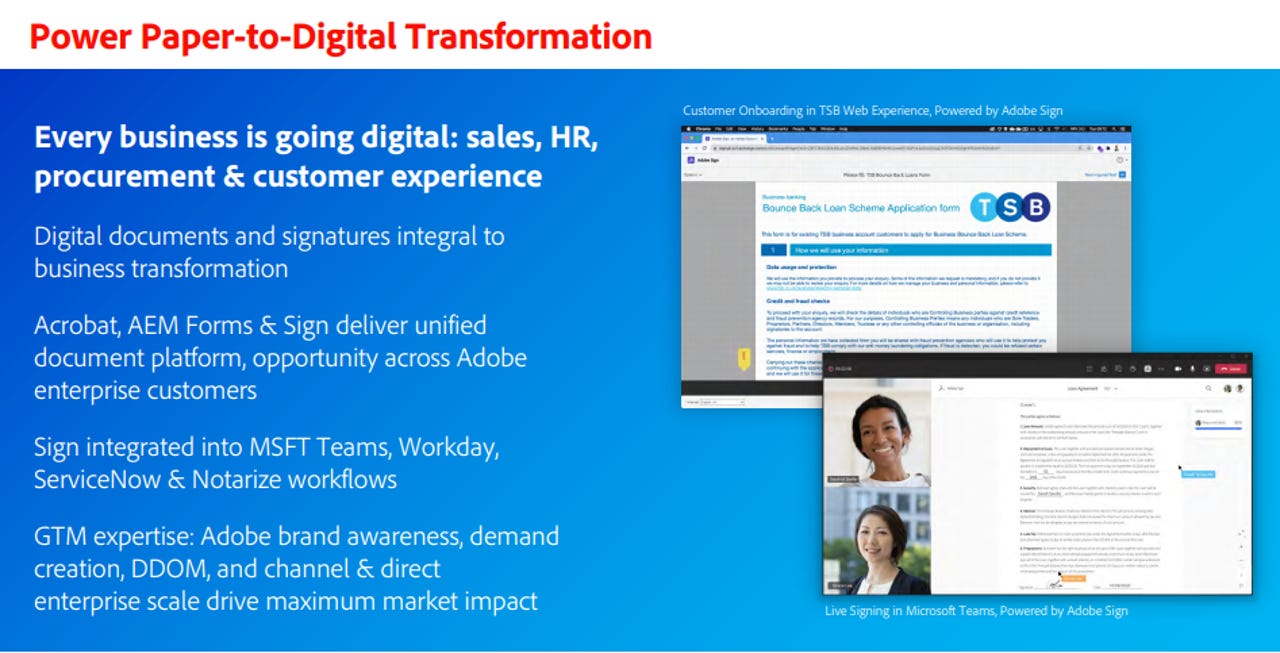

With every business going digital, the strategy is to enable the paper to digital transformation through services that we have like Acrobat, and Adobe Sign, but also to leverage what we deliver through the Adobe Experience platform and the Adobe Experience Manager as well as Adobe Experience Manager Forms. And we want to unleash an entirely new PDF ecosystem with document services, which provides APIs to third party developers, and they will then find new and exciting ways to use PDF and we will be able to monetize those services.

The other aspect of our Document Cloud strategy is to deliver a Unified Document Cloud platform. This includes Acrobat, AM Forms and Adobe Sign, which are central to the way work is getting done today.

DocuSign CEO Dan Springer recently told ZDNet's Tiernan Ray that enterprises launched a digital signature buying spree during the COVID-19 pandemic and move to remote work, but now see document management as a broader digital transformation play. DocuSign on Dec. 3, reported better-than-expected earnings.

Narayen said Adobe's document services platform, which includes e-signature and embedded services, has a $10 billion total addressable market. Adobe can expand its market share due to the "the ability to deliver Adobe Sign to target both the small and medium business as well as the larger enterprise through both seat expansion as well as through document workflows," said Narayen.

Abhay Parasnis, CTO of Adobe, said Document Cloud is leveraging the company's Sensei artificial intelligence platform to better understand documents and summarize them. Parasnis said Adobe was building "document intelligence."

The company said Document Cloud revenue has been driven by Acrobat subscriptions as well as "significant momentum in Adobe Sign." CFO John Murphy said:

The Document Cloud strategy of accelerating document productivity going from paper to digital is really resonating in the remote work environment. The Adobe Sign business has seen a growth inflection this year. In fact, we saw this inflection point before the pandemic head and we expect this trend to continue into FY 2021.