Fitbit cuts Q3, 2019 outlook based on weak Versa Lite demand

Fitbit cut its revenue outlook for the third quarter and 2019 due to weaker-than-expected demand for its Versa Lite device.

The news comes as Fitbit continued to make progress with its enterprise unit, Fitbit Health Solutions, but the company needs to keep its device business humming to maintain its user base. Versa Lite is designed to be a budget smartwatch that doesn't have advanced messaging or third party applications, but make up for it with a lower price and a battery that lasts for days. ZDNet's Matthew Miller gave the Versa Lite high marks, but CNET noted that the device competed with two other Fitbit devices in the $160 range.

Fitbit said its third quarter revenue will fall 10% to 15% from a year ago to $335 million to $355 million with a non-GAAP loss between 11 cents a share and 9 cents a share. Wall Street was expecting third quarter revenue of $399.4 million with a non-GAAP profit of 2 cents a share.

- Fitbit app updated: Redesigned for greater personalization and easier access to tools

- Fitbit Charge 3, Inspire HR added to UnitedHealthcare Motion

- Fitbit's second act: Can the original fitness band maker stage a comeback with healthcare?

- Fitbit's enterprise health unit hits Q1 stride, $122 million annual revenue run rate

For 2019, Fitbit said it will increase devices sold, but have falling average selling prices. Weaker Versa Lite sales will lower revenue to a range of $1.43 billion to $1.48 billion. Analysts were looking for revenue of $1.56 billion. The non-GAAP loss for the year will be between 38 cents a share and 31 cents a share.

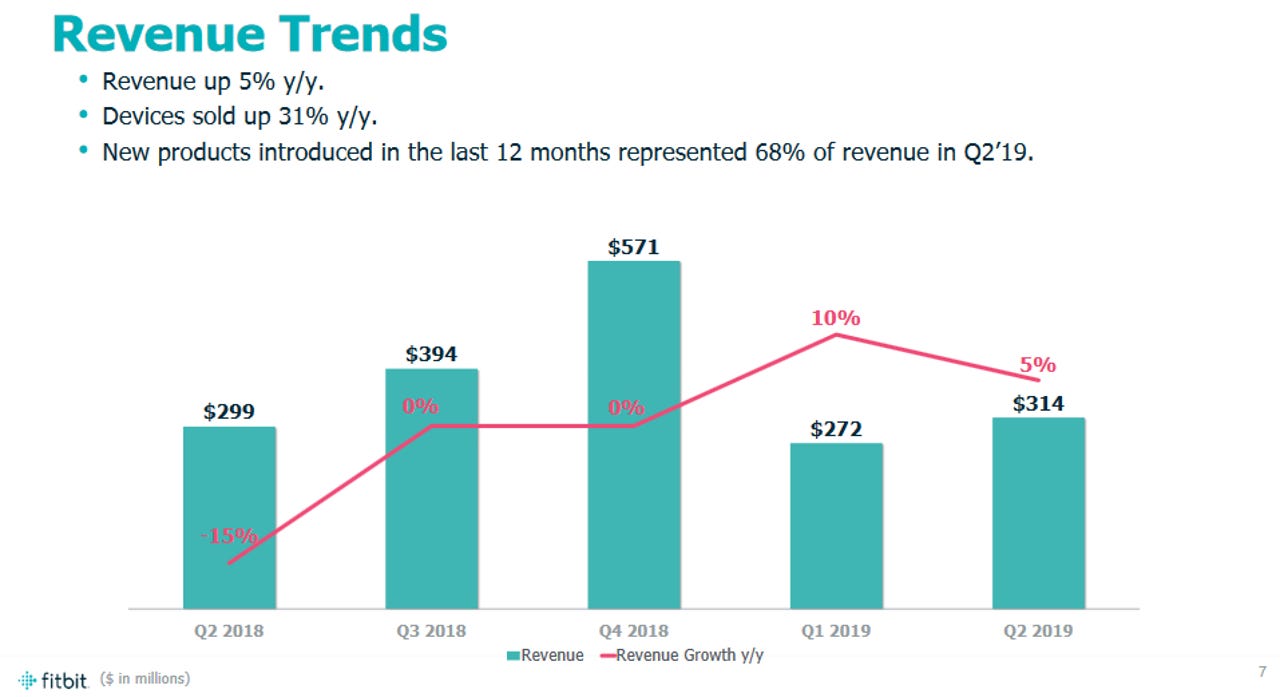

The outlook comes as Fitbit's second quarter results were better than expected. Fitbit reported a net loss of 27 cents a share on revenue of $314 million. Non-GAAP loss for the second quarter was 14 cents a share. Wall Street was expecting a non-GAAP loss of 18 cents a share on revenue of $311 million.

See also

Fitbit CEO James Park said:

While we are disappointed to lower guidance for the year, we remain confident in our long-term transformation strategy and have demonstrated good results across key areas of the business. We saw growth in devices sold, increased active users and continued growth in our Fitbit Health Solutions channel, up 42% in the first half of 2019. In addition, we have made progress in diversifying our revenue towards building more predictable, recurring revenue streams with the launch of our premium services in two test markets.

Park spent some of the earnings conference call outlining what went wrong with the Versa Lite launch plan.

We attribute the Versa weakness to a pricing go-to-market strategy. We added Versa Lite to our product lineup in Q1 intend on lowering the barrier to entry for consumers to purchase a quality smartwatch with certain core features and shifted to an everyday low-pricing strategy from a promotional. This resulted in lower promotional dollars spent and less sell-through. While Versa Lite received good present consumer reviews, we saw that consumers were willing to pay more for a smartwatch with additional features or look for discounting versus everyday value.

Park added that Fitbit will evaluate its pricing and promotion strategy for future hardware launches as well as accelerate its product development cadence.

Key figures to note:

- Fitbit Health Solutions saw revenue up 42% in the first half of the year.

- Fitbit's direct to consumer offerings and coaching were 10% of sales.

- Tracker revenue was 59% of Fitbit revenue with sales up 51% in the second quarter. Smartwatch revenue fell 27% from a year ago.

- Devices sold were up 31% from a year ago to 3.5 million. Average selling prices were $86 per device.

- In the second quarter, Fitbit Health Solutions revenue was up 16% from a year ago.