Google talks up APAC cloud support as Alibaba intensifies gameplay

Google is playing up its expanding cloud footprint in Asia-Pacific and global network coverage as key differentiators in a market, where Alibaba has been ramping up its cloud play.

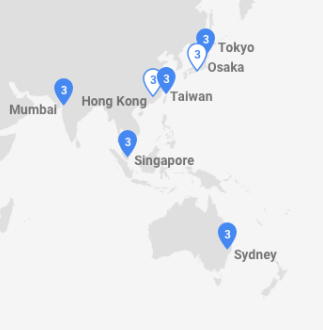

Google currently operates five cloud regions in the region, including Singapore, Mumbai, and Sydney, with another two soon to go live in Osaka and Hong Kong. This would bring the total to seven by year-end or early-2019, up from just one region two years ago, said Rick Harshman, Google's Asia-Pacific managing director for cloud.

And the need for potential new locations would be assessed based on customer and partner demand, said Harshman, who was speaking to ZDNet on the sidelines of Google Cloud Summit in Singapore.

He added that cloud was a fast-growing business for the company, clocking more than US$1 billion in revenue a quarter and a three-fold increase in the number of million-dollar deals.

These are global numbers, though, as Google does not break down its cloud revenue or customer numbers by region.

Google's APAC cloud regions and zones

The vendor in May added its third cloud zone in Singapore and, just last month, announced it was building its third data centre in the city-state. Worldwide, it added 13 cloud regions over the past two years, pushing its current total to 17.

In addition, all its regions in Asia-Pacific have at least three cloud zones, which is a commitment the company has made to ensure customers have high availability and scalability. Each cloud zone is isolated from other zones within the same region. It also enables Google services such as Cloud Spanner to be made available, since it maintains three read-write replicas--each held in a cloud zone.

Google, though, faces potential competition from Alibaba, which has deep pockets and is ramping up its own cloud gameplay.

The Chinese internet giant last month launched several cloud products for the global market and its Asean Partner Alliance Programme. It also earmarked Asia-Pacific as a growth priority, with eight of its 10 international datacentre regions located in this region, including Singapore, Indonesia, and Malaysia. It operates another eight regions in China.

In its latest quarter, Alibaba's cloud revenue grew 93 percent to US$710 million. Worldwide, it has more than 1 million paying cloud customers.

In a recent ZDNet report, the Chinese vendor noted that it had more data centres in Asia-Pacific in the region than its global competitors and was focused on offering localised cloud products and services for customers in this region. It also pointed to its roots and experience in China as a key advantage.

Alibaba is the leading public cloud provider in China, where it has a 47.6 percent market share. Cloud, however, remains a small part of the company's business, accounting for just 5 percent of its overall revenue for its fiscal 2018.

Asked about the competition, Harshman said Google's focus was on its customers and meeting their requirements.

He noted that cloud adoption still was in its early stage, with just 5 percent to 10 percent of workloads estimated to currently be on cloud platforms. This presented tremendous opportunities for multiple cloud providers, he added.

The Google exec, though, was quick to stress the importance of Asia-Pacific as a growth region. Apart from expanding its datacentre footprint, Harshman said, Google had been investing significantly in building out its fibre network coverage here. These efforts included undersea cables connecting Hong Kong, Australia, and Singapore, as well as Australia and Southeast Asia.

Google has said that building and owning its own subsea cables enables it to control the design and construction process, including technical specifications, so it can make routing decisions optimised for latency and availability. It has more than 100 points-of-presence globally.

Harshman noted that including Asia in such investments underscored the region's importance and growth from a customer perspective. He also pointed to Google's efforts in building developer communities, encompassing various technology subsets such as TensorFlow and Kubernetes, as a competitive differentiator.

AirAsia flies towards serverless architecture

The quest for a serverless environment, though, was the primary reason AirAsia made the decision to migrate to Google Cloud, according to the budget airline's chief data and digital officer, Nikunj Patel.

Speaking to ZDNet on the sidelines of the summit, Patel said AirAsia had evaluated several vendors including Alibaba, Microsoft Azure, and Amazon Web Services (AWS) before settling on Google.

The airline assessed these options based on their investment in serverless technology and auto-scaling and auto-provisioning capabilities, he said. "A lot of cloud providers are still doing IaaS and VMs, and we skipped that from a architecture point of view... As we're architecting for the future, we're looking at serverless and PaaS-type of infrastructure, and not all cloud vendors have that."

AirAsia also needed robust connectivity and, with Google running its own network, it "gives us better pipes", he said, and highlighted a notable difference in connectivity speed when his team tested against the networks of AWS and Alibaba.

He added that language also was a challenge with Alibaba, which had a team in Singapore but key cloud expertise were based in its Hangzhou headquarters.

With a fleet of more than 200 aircrafts, AirAsia's nine airlines run more than 300 routes to 136 destinations worldwide. It served more than 70 million passengers last year and was projected this figure to climb to 90 million this year.

Its had plotted a three-year journey to move its applications and processes to the cloud, largely so it could become a data-driven digital company, Patel said.

As the company continued to grow, it also was collecting more and more information about its customers, who increasingly also were expecting the airline to better understand their needs and provide a ubiquitous experience. To do that, he said, AirAsia had to transform its business operations and overall customer journey, both offline and online.

The carrier was targeting to move everything to the cloud by 2019, he noted, adding that its mobile app already had made the transition, while its booking engine was slated to go into beta launch by next week.

Some legacy airline operational systems currently still were running on-premise, and would need to be virtualised and tested before they could be migrated to the cloud or a native-cloud software platform, he said.

AirAsia currently also is tapping machine learning to power recommendations on its homepage, suggesting routes that travellers may be interested in as well as listing ancillary products such as seat or meal options based on the type of flights.

For instance, seat options would be placed first for passengers taking a short flight between Singapore and Kuala Lumpur, while meal or baggage options would be prioritised for passengers on longer flights.

Plans now were underway to use machine learning for predictive maintenance, tapping data to better predict when parts needed to be replaced or serviced, Patel said. This would require all of its aircrafts to be outfitted with thousands of sensors, so data could be collected and analysed.

Moving forward, he noted, AirAsia would expect its cloud partners to continue investing in new applications and zones, as well as ensure its services were available across the globe.