Retailing, digital transformation, IT skills, and personal computing: Research round-up

The Future of Retail: Getting to grips with emerging technologies

Let's start with our special report on the Future of Retail, which suggested 'business as usual' is not an option in the retail sector, thanks to new technologies, changing patterns of consumer behaviour, and the influence of pioneering digital-first companies like Amazon. Our research suggests the key challenge facing the retail sector is getting to grips with emerging technologies, such as augmented reality, voice, the Internet of Things (IoT) and 3D printing.

For more see: The Future of Retail: 2018 and beyond

The Future of Retail: Some firms are lagging when it comes to change

Additional research in our report suggests more than half of retailers have still not started digital transformation. We believes the correct response to these seismic changes will vary from business to business, but some themes will recur: better data about customer requirements and behaviour, and better analysis of that data; new ways of deploying physical stores, leveraging engaging new technologies like AR and IoT; new payment systems -- especially mobile ones; and faster, more convenient purchase fulfilment.

For more see: The Future of Retail: 2018 and beyond

Digital transformation: Retooling business for a new age

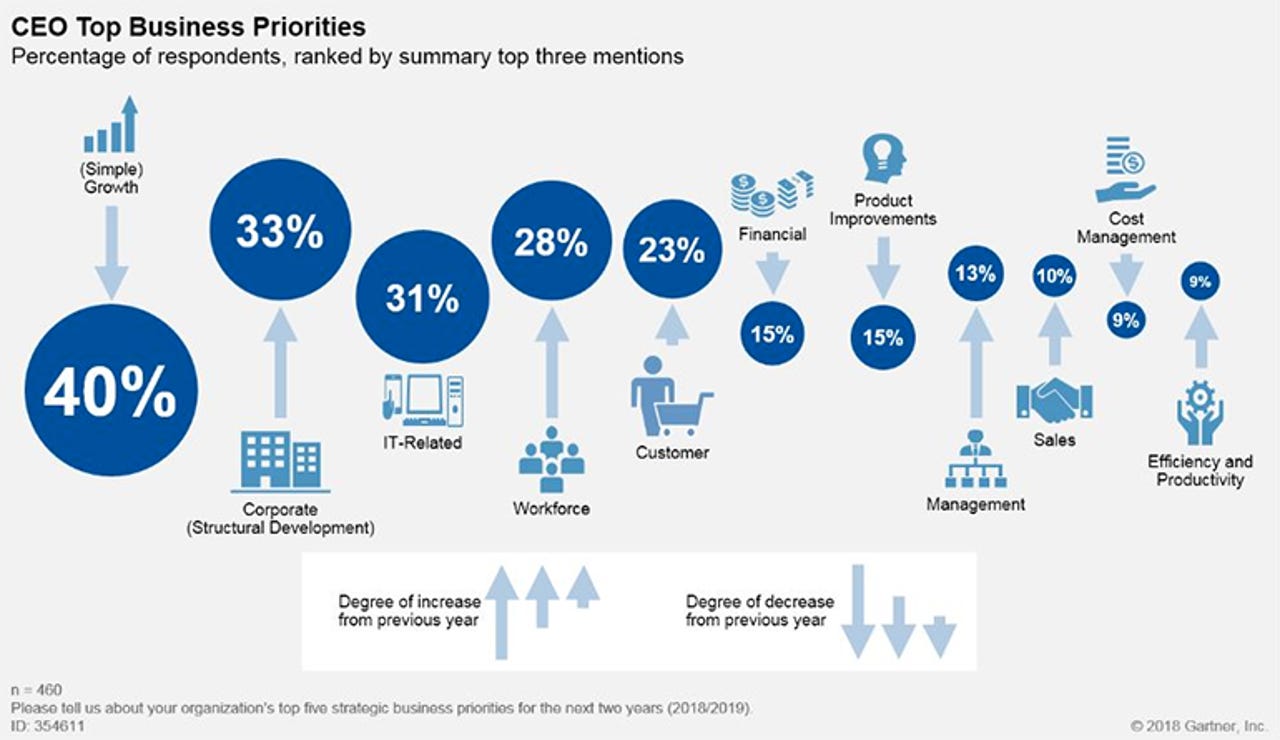

We also updated our analysis of some of the wider trends around digital transformation. For a pointer to business leaders' high-level priorities in 2018/19, we can examined Gartner's 2018 CEO and Senior Business Executive Survey, which canvassed 460 CxOs. Gartner VP Mark Raskino said that although growth remains the CEO's biggest priority, there was a significant fall in simple mentions of it this year, from 58 percent in 2017 to just 40 percent in 2018.

For more see: Digital transformation: Retooling business for a new age

The sorry state of digital transformation in 2018

Our update also considered Forrester's recent report entitled 'The Sorry State Of Digital Transformation In 2018'. The survey of 1,559 North American and European enterprise business and technology decision makers found more than half of firms are transforming -- and a very confused 21 percent believe they've finished. Digital transformation, as our analysis suggests, is a constant work in progress.

For more see: Digital transformation: Retooling business for a new age

Closing the skills gap: Preparedness of recruits to perform at a high level

We also looked at the skills gap. To better understand tomorrow's talent, Bloomberg Next in collaboration with Workday recently surveyed 200 corporate and education leaders. Our analysis of the research highlighted how new hires are not well-prepared to perform at a high level in a professional environment, primarily because of insufficient soft skills. Only 35 percent of corporations believe students are well-prepared with both hard and soft skill sets -- compared to 44 percent of respondents from academia.

For more see: Closing the skills gap requires business and academia collaboration

Closing the skills gap: 5 most important soft skills

The research also assessed in-demand capabilities. Survey respondents from both business and academia agreed the most important soft skills are teamwork, analytical reasoning, complex problem solving, agility, adaptability, and ethical judgment.

For more see: Closing the skills gap requires business and academia collaboration

Gartner says the PC industry delivered year-over-year shipment growth

Propelled by a strong enterprise upgrade cycle, PC shipments posted their first year-over-year quarterly growth in six years, according to Gartner data. Now PC shipments weren't posting crushing growth, but the industry will take what it can get. Second quarter units were 62.1 million, up 1.4 percent from a year ago. The PC industry hasn't posted growth year over year since 2012.

For more see: Windows 10 business upgrade cycle gives PC industry rare shipment growth

Microsoft Surface shipments already bucking the trend

Actually, some new signs life in the personal-computing market have been emerging for a while. While PC shipments overall have been flat or down for the past four years, the Surface business has been growing at a compound annual rate of better than 22 percent a year. To put that in perspective, in less than six years, the Surface business has grown to roughly 20 percent of the size of Apple's entire Mac business.

For more see: Surface by the numbers: How Microsoft reinvented the PC

Windows 10 is maturing steadily

We also noted that as Windows 10 approached its third birthday, it's maturing steadily. A worldwide installed base of more than 700 million active users is impressive, but there's still some way to go. Usage data from the United States Data Analytics Program offers a good measure of how that migration has been going so far. As of June 30, 2018, Windows 7 still accounts for nearly 40 percent of visits to U.S. government websites from Windows PCs.

See more here: Windows 10 after three years: A greatly improved report card

Microsoft is faring well across most of its business units

Yet the good news for the Redmond-based giant is that Microsoft's Q4 results show it is faring well across most of its business units as annual revenue topped $110 billion. By unit, Microsoft's productivity and business processes division had fourth quarter revenue of $9.7 billion, up 13 percent from a year ago. Office commercial products and cloud services revenue was up 10 percent with consumer Office up 8 percent.

For more see: Microsoft Q4 strong as commercial cloud revenue hits $6.9 billion

Amazon posts big Q2 earnings beat but misses revenue target

Amazon, meanwhile, published its second quarter financial results late July, beating earnings estimates but falling short of revenue expectations. The Seattle-based tech giant posted net income of $2.5 billion in the second quarter, or $5.07 per diluted share. Revenues came to $52.9 billion, up 39 percent year-over-year. Amazon Web Services' net sales came to $6.1 billion for the quarter, growing 49 percent year-over-year.

For more see: Amazon posts big Q2 earnings beat but misses revenue target

Does Amazon need a smartphone to win the smart home battle?

We also looked at Amazon's plans and considered the potential for a new smartphone, similar to the Fire Phone, running on Fire OS, which it launched in 2014. The phone was not a success and Amazon stopped selling it a year later. Yet the Fire OS hasn't gone away; Fire OS continues to be used on Amazon's tablets, its Kindle e-readers and Fire TV stick. According to IDC, Amazon's Fire OS based tablets accounted for about 10 percent of the overall market in 2017.

For more see: Does Amazon need a smartphone to win the smart home battle?