Google's display ad gravy train rests with YouTube

Citigroup analyst Mark Mahaney has high hopes for Google's prospects in display advertising--so much so that every 1 percent gain in the company's display ad market share will result in $200 million in additional revenue in 2009. All Google has to do now is figure out how to monetize YouTube.

How will Google grow share? Mahaney outlined three key possibilities in a research note Thursday:

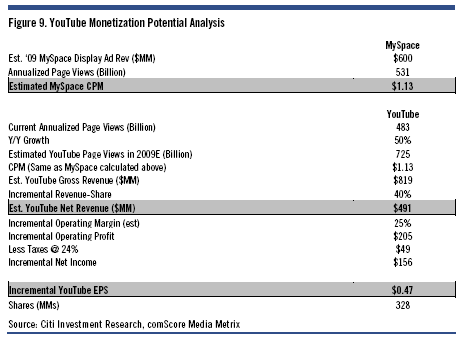

YouTube: Mahaney reckons that Google will figure out the monetization puzzle for YouTube and generate an additional $500 million in revenue in 2009. My take: I'm not convinced that Google will crack the YouTube ad code that early. Google will figure it out and when it does YouTube may be a cash cow. Mahaney compares YouTube to MySpace in terms of monetization:

Owned and operated sites: Mahaney figures that Google Videos, Images, Maps and Finance could yield display ad potential to the tune of $265 million in incremental 2009 revenue. My take: This is a no brainer. Those sites aren't nearly as monetized as they could be.

DoubleClick: Google is generating $250 million in additional 2009 revenue, but it's unclear about the long-term profit impact, says Mahaney. However, DoubleClick has given Google an entry into display ads and that's all that really matters. Chances are good that Google can do more a lot more with DoubleClick. But there are challenges: Google has to connect DoubleClick's cookie files with the rest of the network and convince agencies to stick around since advertisers are looking to diversify.

Mahaney's case for Google boils down to this: Google will continue to grow search share and use display ads as a turbo charger.

Writes Mahaney:

To date, Google has had very little traction in the Display Advertising market. While Google has a Display advertising solution and serves some Display ads on some of its properties (primarily YouTube), we believe that its share of Display advertising in the U.S. is well below 5% currently. But were Google to effectively address the Display Ad market, we believe the results could have a material impact on its P&L. To quantify this potential, we analyzed what a 1% share gain in the Global Display Ad market would mean for Google and its 2009 fundamentals. By 2009, we estimate the Global Display Ad market to be $19.8B. Thus, every 1% share of this market would equate to roughly $200MM in incremental revenue.

Here's the breakdown, which excludes revenue sharing deals:

These projections are no slam dunk but given how Yahoo and Microsoft have been distracted in display advertising there's a big opening for Google.