HP earnings: Strong first quarter results, 2010 outlook

HP delivered strong first quarter earnings Wednesday and raised its outlook for 2010 in a move that signals that the company is set to gain amid PC and server upgrade cycles.

The company reported first quarter net income of $2.3 billion, or 96 cents a share, on revenue of $31.2 billion, up 8 percent from the year ago quarter. Non-GAAP earnings were $2.7 billion, or $1.10 a share.

Wall Street was expecting earnings of $1.06 a share on revenue of $30.01 billion.

Meanwhile, HP raised its outlook for fiscal 2010 and the second quarter (statement, preview).

For the second quarter, HP is projecting revenue between $29.4 billion and $29.7 billion. Earnings will be 89 cents a share to 91 cents a share under generally accepted accounting principles (GAAP). Non-GAAP earnings are expected to be $1.03 to $1.05 a share. Wall Street was looking for earnings of $1.03 a share on revenue of $29.03 billion, according to Thomson Reuters.

HP's outlook for fiscal 2010 was also better than expected. The company projected revenue of $121.5 billion to $122.5 billion, up from its previous estimate of $118 billion to $119 billion. GAAP earnings will be $3.79 to $3.86 a share with non-GAAP earnings of $4.37 to $4.44 a share. Wall Street was looking for earnings of $4.37 a share on revenue of $120.3 billion.

In a call with analysts today, company CEO Mark Hurd called HP's portfolio one of the best and broadest in the industry, noting that the company is No. 1 or No. 2 in every category where it competes. He said the investment to ensure innovation in technology will continue, noting that the customers put value in innovation, scale, usability and affordability, among other things. He said HP's market coverage in IT is strong and that cost initiatives are paying off, noting a double-digit growth in revenue-per-employee.

Hurd made a point of saying that HP's best days lie ahead. It's a far cry from what companies were saying not so long ago as uncertainty around the economy had execs guessing. Pair that comment with the boost in earnings forecasts and it feels safer to say that the worst of the economy is in the past.

From today's call with analysts.

- The company is starting to see more activity in software and services space. It sees the momentum continuing, noting that if the market is better, then the company does better. The guidance is based on what's happening now, with predictions based more on first quarter activity.

- There are opportunities for additional sales people in the company. Yes, HP is hiring.

- In terms of PC sales, there was strength among consumers in the quarter and that's expected to continue for the first part of the year. The corporate refresh is expected in the "back half of the year."

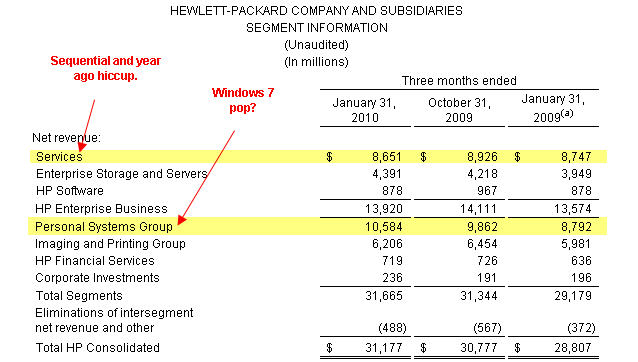

By the numbers:

- HP's revenue by geography was strong everywhere but Europe---a big worry spot given the economic turmoil in the EU over Greece. Europe, Middle East and Africa revenue was up 1 percent to $12.1 billion.

- Other areas were strong. Revenue in the Americas was up 9 percent to $13.6 billion. Asia Pacific revenue was up 26 percent to $5.4 billion. Revenue outside the U.S. was 65 percent of total HP revenue.

- As expected, HP's enterprise storage and servers unit showed solid gains with revenue of $4.4 billion, up a year ago. Industry standard server revenue jumped 27 percent. HP is benefiting from a server upgrade cycle driven by Intel's Nehalem architecture. The unit had an operating profit of $552 million, up from $406 million a year ago.

- HP's PC unit had a 26 percent increase in unit shipments and was the big market share dog. Revenue for the unit was $10.6 billion, up 20 percent from a year ago. Notebook revenue was up 25 percent and desktop revenue was up 16 percent. Operating profit was $530 million, up from $436 million a year ago. HP cited strength in its HP TouchSmart line.

- Services revenue fell 1 percent to $8.7 billion. Operating profit was $1.4 billion. IT outsourcing revenue was up 2 percent and technology services fell 2 percent.

- HP Software revenue was flat at $878 million with an operating profit of $167 million, up from $140 million a year ago.

- HP is also improving its efficiency with inventory down 6 days to $6.6 billion.

- Imaging and printing revenue was up 4 percent to $6.2 billion. Operating profit was $1.1 billion, flat with a year ago. Analysts were expecting flat growth so that tally may be counted as a win.

A few quick notes on the results: