Salesforce acquires Slack for $27.7 billion in its largest acquisition ever: Here's the plan

Salesforce said it will acquire Slack in an all-stock deal valued at $27.7 billion, as the company aims to expand its footprint more into collaboration and workflows. Slack will essentially become the front end to Salesforce's Customer 360 efforts.

The acquisition, which leaked last week, sets up a showdown with Microsoft and its Teams platform. Salesforce and Microsoft also compete in CRM (Dynamics vs. Sales Cloud) and analytics (Tableau vs. PowerBI). Under the terms of the agreement, Slack shareholders will receive $26.79 in cash and 0.0776 shares of Salesforce common stock for each Slack share.

In a statement, Salesforce CEO Marc Benioff said the plan is to combine Slack with Salesforce Customer 360. On a conference call, Benioff added:

This is the next generation of the Customer 360. This is our ultimate vision of having this incredible user interface on top of all of these services with all these channels and all the collaboration running on all these devices and integration, interactions.

We see in Slack a once-in-a-generation company platform. It's the central nervous system of so many companies on this call and our company and so many of our great customers, connecting everyone and everything, and now we could go even bigger, better, more exciting. And it brings all the companies, people, the data, the tools together. And you can see all the CRM information, the sales the customer interactions. You also saw Slack Connect, which extends the benefit of Slack so employees can securely work and collaborating with partners, suppliers, customers.

For Salesforce, the Customer 360 link with Slack Connect, which enables enterprises and partners to collaborate, is compelling. The Slack purchase won't be Salesforce's first foray into collaboration. Salesforce launched Chatter in 2009, bought Quip in 2016, and just rolled out Salesforce Anywhere. Stewart Butterfield, Slack CEO, said the Salesforce acquisition is "the most strategic combination in the history of software."

Previously: Salesforce and Slack: A vision of collaborative sales, service with a dash of Microsoft defense | Salesforce could buy Microsoft Teams rival Slack next week

Benioff noted that he has been talking about the social enterprise for a long time, but thinks the Slack deal brings the original vision to life.

I think these collaborative interfaces and video-based interface is sort of the next major moment in our industry. But underneath those services, you have so many rich services, application, integrations, artificial intelligence, and fundamentally, big fata lakes. How can you take all of that and bring it to the user to the power professional to the worker to the knowledge user or even to the CEO and turn it into a powerful experience?

According to Slack's third quarter release, the company had more than 64,000 paid customers using Slack Connect in the third quarter, up from 52,000 in the second quarter. There are more than 520,000 connected endpoints on Slack Connect.

Slack's ability to bridge companies and partners via its Slack Connect would be critical to Salesforce, which has Customer 360 but largely stays within the confines of the enterprise. Salesforce's purchase of Slack gives it more heft vs. Microsoft and plays in a broader theme of Salesforce as the connector on multiple fronts such as applications (MuleSoft), analytics (Tableau), and collaboration (Slack).

The competitive landscape

The Salesforce-Slack deal lands as the competitive landscape is shifting across multiple categories. Sales and service have gone virtual amid the COVID-19 pandemic and will largely remain that way. Yes, folks, travel budgets for sales teams aren't going to come all the way back amid remote work.

In addition, Salesforce's biggest CRM rivals have collaboration platforms. Microsoft has Teams and its integration with Office 365 and a platform play. And Adobe just acquired Workfront and can integrate that project management platform with its clouds. Communication and customer experiences are merging: Note that Twilio's $3.2 billion purchase of Segment illustrates the trend.

The competitive axis in CRM is Microsoft with partners like Adobe and C3.ai vs. Salesforce.

For Slack, Salesforce will give it more heft to compete with Microsoft Teams, Google Meet, and a host of other players in video conferencing like Zoom that could add messaging.

Wedbush analyst Daniel Ives said Salesforce's acquisition of Slack is about keeping pace with Microsoft and Teams, developing a broader cloud platform approach and acknowledging that collaboration software will be a key category even when employees return to the office in some form.

But the biggest item that pushed the Salesforce-Slack deal was Microsoft, said Ives in a research note:

The core reason for this deal in our opinion is to keep pace with the cloud behemoth in Redmond. Microsoft with its Azure/Office 365 cloud stack and Teams enterprise messaging solution set has dominated the cloud over the past few years and accelerated its growth during this COVID-19 backdrop. With Salesforce having a treadmill approach to collaboration software with its Chatter solution and its 2016 acquisition of Quip gaining minimal traction, it was "now or never" to do a deal for Benioff. Slack despite facing stiff competition from Microsoft has been a clearly successful solution set further penetrating enterprises and thus looks like the natural fit for Salesforce to beef up its collaboration and messaging footprint and keep pace with Nadella & Co. with its cloud dominance.

Here's a look at Salesforce's core clouds and growth trends.

The plan

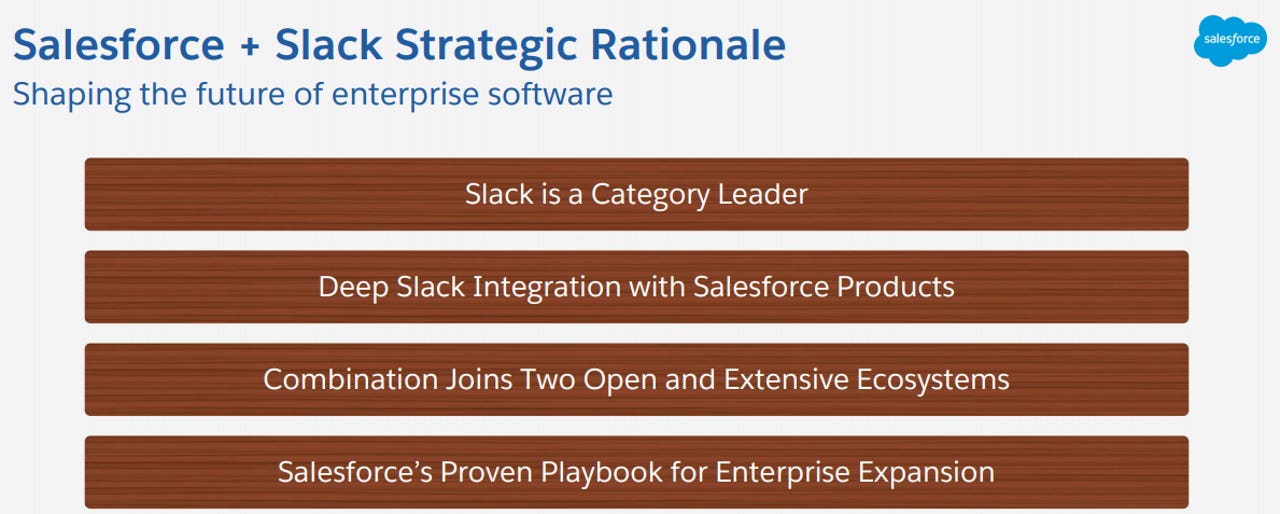

At a high level, the companies said the combination is about the future of work, revamping workflows, data and connecting customers, employees, and partners.

On a more concrete level, Slack becomes the new interface for Customer 360.

The companies said:

Slack will be deeply integrated into every Salesforce Cloud. As the new interface for Salesforce Customer 360, Slack will transform how people communicate, collaborate and take action on customer information across Salesforce as well as information from all of their other business apps and systems to be more productive, make smarter, faster decisions and create connected customer experiences.

Salesforce will also leverage Slack's open platform, which integrates more than 2,400 apps. Salesforce said the companies combined will have a strong developer ecosystem.

The deal is expected to close in the second quarter of Salesforce's fiscal second quarter.

Bret Taylor, president and operating chief of Salesforce, said Slack will remain independent but there are areas where joint customers will benefit. The integration playbook for Slack will rhyme with what Salesforce accomplished with MuleSoft and Tableau. Taylor said:

I think our philosophy is very similar to our philosophy with MuleSoft and Tableau, which is, number one, starting with our mutual customers and starting for how can we help every one of our customers benefit from the combination of these two technologies.

If you look at the happiest customers who use Slack, it is really that central nervous system for their company. And that's really connecting every single application at their company, not just applications from Salesforce. So that really is balancing, making sure Slack has an independent brand and continues to serve every single company and integrates with every single system at your company while also making sure that it really achieved that vision that Marc talked about, which is it really becomes sort of the user interface for the Customer 360.

Third quarter results for Salesforce and Slack

Salesforce also reported fiscal third quarter results and initiated fiscal 2022 revenue, which will include about $600 million in revenue from Slack.

The company reported third quarter revenue of $5.42 billion, up 20% from a year ago. Earnings for the quarter were $1.15 a share and $1.74 non-GAAP.

Wall Street was expecting third quarter revenue of $5.25 billion and non-GAAP earnings of 75 cents a share.

For the fourth quarter, Salesforce projected revenue of $5.66 billion to $5.67 billion, up about 17% from a year ago. Non-GAAP earnings will be between 73 cents a share to 74 cents a share.

For fiscal 2021, Salesforce is projecting $21.10 billion to $21.1 billion in revenue. For fiscal 2022, Salesforce is projecting revenue between $25.45 billion and $25.5 billion.

In some respects, Salesforce is buying growth.

Slack, which reported its third quarter results, said it added 12,000 net new paid customers. The company ended the quarter with 142,000 paid customers, up 35% from a year ago.

The company reported fiscal third quarter revenue of $234.5 million, up 39% from a year ago, with non-GAAP earnings of a penny a share. Slack reported a net loss of 12 cents a share.

Slack also said it had 1,080 customers spending more than $100,000 annually.