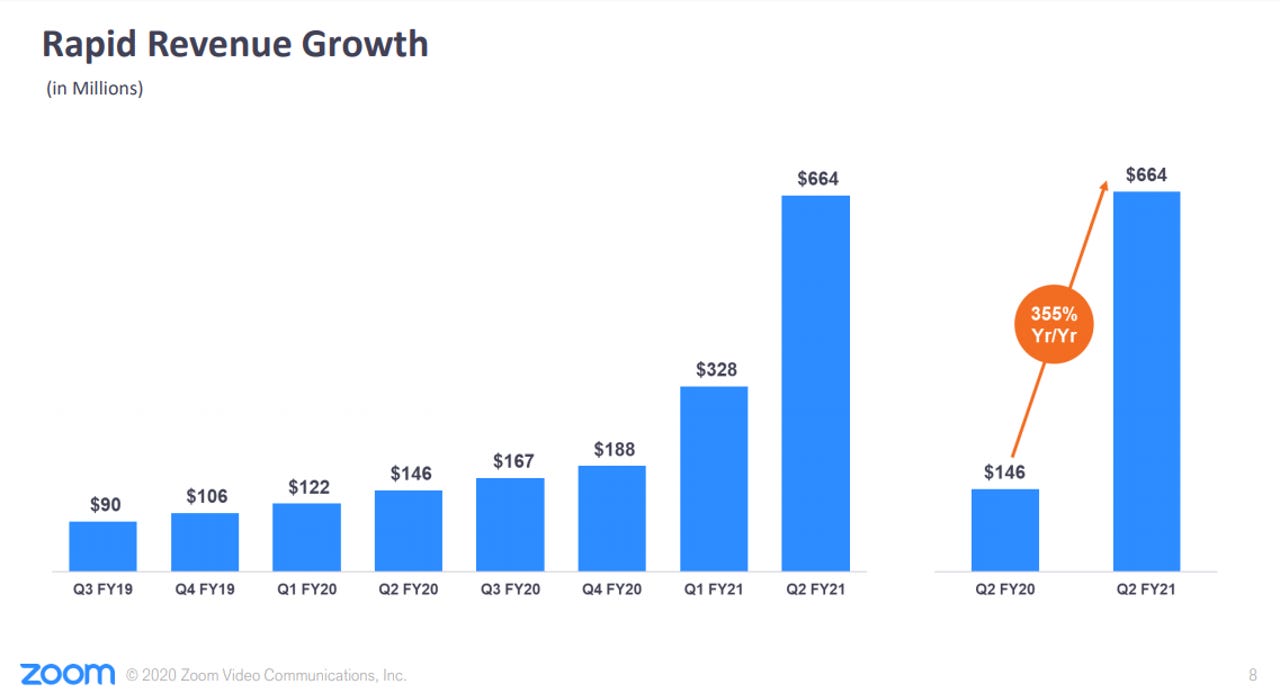

Zoom posts another stellar quarter, with revenue up 355 percent

Video communications provider Zoom on Monday published quarterly financial results that once blew past market expectations thanks to strong tailwinds from the COVID-19 pandemic subsequent shift to remote work. Its stellar second quarter growth -- which saw revenue up 355 percent year-over-year -- was attributed to companies moving towards long-term remote work planning.

Non-GAAP net income for the quarter was $274.8 million, or 92 cents per share. Revenue came to $663.5 million, up 355 percent year-over-year.

Analysts were looking for non-GAAP earnings of 45 cents on revenue of $500.45 million.

"Organizations are shifting from addressing their immediate business continuity needs to supporting a future of working anywhere, learning anywhere, and connecting anywhere on Zoom's video-first platform," Zoom founder and CEO Eric S. Yuan said in a statement. "At Zoom, we strive to deliver a world-class, frictionless, and secure communication experience for our customers across locations, devices, and use cases."

He credited the company's strong quarter to its "ability to keep people around the world connected, coupled with our strong execution."

The company ended the quarter with approximately 370,200 customers with more than 10 employees, up 458 percent year-over-year.

The number of customers contributing more than $100,000 in trailing 12 months revenue was 998, up 112 percent year-over-year.

Zoom highlighted a couple major new customers it won in the quarter -- namely, ExxonMobil and Activision Blizzard -- as well as customers that expanded their business with Zoom, such as ServiceNow.

For the quarter, the year-over-year growth in revenue was primarily due to subscriptions provided to new customers, which accounted for approximately 81 percent of the increase. Subscriptions provided to existing customers accounted for approximately 19 percent of the increase. This demand was broadbased across industry verticals, geographies and customer cohorts, CFO Kelly Steckelberg said Monday.

- SEE: Photos: The 73 coolest virtual backgrounds to use in Zoom meetings (TechRepublic)

- SEE: Zoom 101: A guidebook for beginners and business pros (TechRepublic Premium)

Zoom's business in the Americas grew at a rate of 288 percent year-over-year. Its combined APAC and EMEA revenue accelerated to 629 percent year-over-year and represented approximately 31 percent of revenue.

For the third quarter, Zoom expects total revenue between $685 million and $690 million. Non-GAAP diluted EPS is expected to be between 73 cents and 74 cents.

Analysts are expecting revenue of $492.9 million.

For the full fiscal year 2021, Zoom is increasing its revenue outlook to approximately $2.37 billion to $2.39 billion, or an increase of 281 percent to 284 percent year-over-year."

MUST READ:

- The complete Zoom guide: From basic help to advanced tricks

- 3 things you shouldn't do before a Zoom meeting (and another 3 you should always do)

- NSA security guide: How to choose safe conferencing and collaboration tools

- Zoom's torrid 90-day sprint: Security, increased competition and becoming a verb

Back in March, when Zoom reported its fourth-quarter earnings for fiscal year 2020, the company didn't even mention the COVID-19 pandemic in its press release. But by the first quarter, Zoom had become a household name. As work-from-home arrangements became the norm as countries locked down their economies, Zoom went from and enterprise video collaboration platform to one of those rare companies that became a verb. We don't Skype. We don't Microsoft Teams. We don't Google Meet. We don't WebEx. We Zoom even when we're using another platform, say Blue Jeans or GoToMeeting. Zoom became a public company with a go-to-market strategy that relied on the upsell, viral demand, and word of mouth. Zoom had buzz and then some.

Enter Zoom happy hours. Zoom birthdays. Zoom doctor appointments. Even Zoom funerals. Families stayed connected, educational institutions went to class virtually and enterprises realized that they could maintain productivity and sales with the help of collaboration tools like Zoom. Even UK parliament ran on Zoom.

But Zoom's transition from enterprise video conferencing company to household name and part social network brought more attention. Hackers began to poke holes in Zoom's infrastructure. Some enterprises and organizations dropped Zoom due to security concerns—and likely good deals from rivals. In the last full week of August, as millions of children and teachers attempted to start the school year online, Zoom suffered a widespread outage in the US. The issue was resolved within a few hours but not before causing chaos for online learners. More than 100,000 K-12 schools have signed up to use the platform for free during the pandemic, Zoom said Monday.

Security concerns and outages have given rivals an opening. Usage of Microsoft Teams surged as the software and cloud giant ramped up marketing and added new features. Google rushed to make Google Meet a common part of the G Suite experience. Verizon bought Blue Jeans for its enterprise unit. Facebook launched Workplace Rooms for B2B and Messenger Rooms for consumers in a bid to give video conferencing a social twist. In addition, Zoom's infrastructure providers also became strong rivals. Zoom runs its own data centers, but also burst to the cloud. Given the big three cloud providers all have video collaboration tools, Zoom cut in Oracle Cloud as a partner.

This tale could have been one of an upstart making a technology mainstream and getting squashed by giants, but Zoom's response to its security issues was swift and decisive even as best practices were written on the fly.