CommScope buys ARRIS for $7.4 billion

Featured

Telecommunications equipment maker CommScope is buying set-top box maker ARRIS for $7.4 billion in cash, the companies announced Thursday. Private equity firm The Carlyle Group is partially funding the deal via a $1 billion minority equity investment in CommScope, which has a market cap of about $4.8 billion.

CNET: Best Black Friday deals 2018 | Best Holiday gifts 2018 | Best TVs to give for the holidays

Georgia-based ARRIS has a presence in the cable wireline broadband space and a significant chunk of its revenue comes from its pay TV set-top business. The company bulked up by buying Motorola Mobility's home unit from Google in 2012 and Pace, a U.K.-based set-top box manufacturer, in 2015. In 2017, ARRIS acquired Ruckus Wireless from Broadcom.

CommScope has evolved from one of the world's largest providers of coaxial cable for businesses and telephone companies to a broad manufacturer of telecom gear.

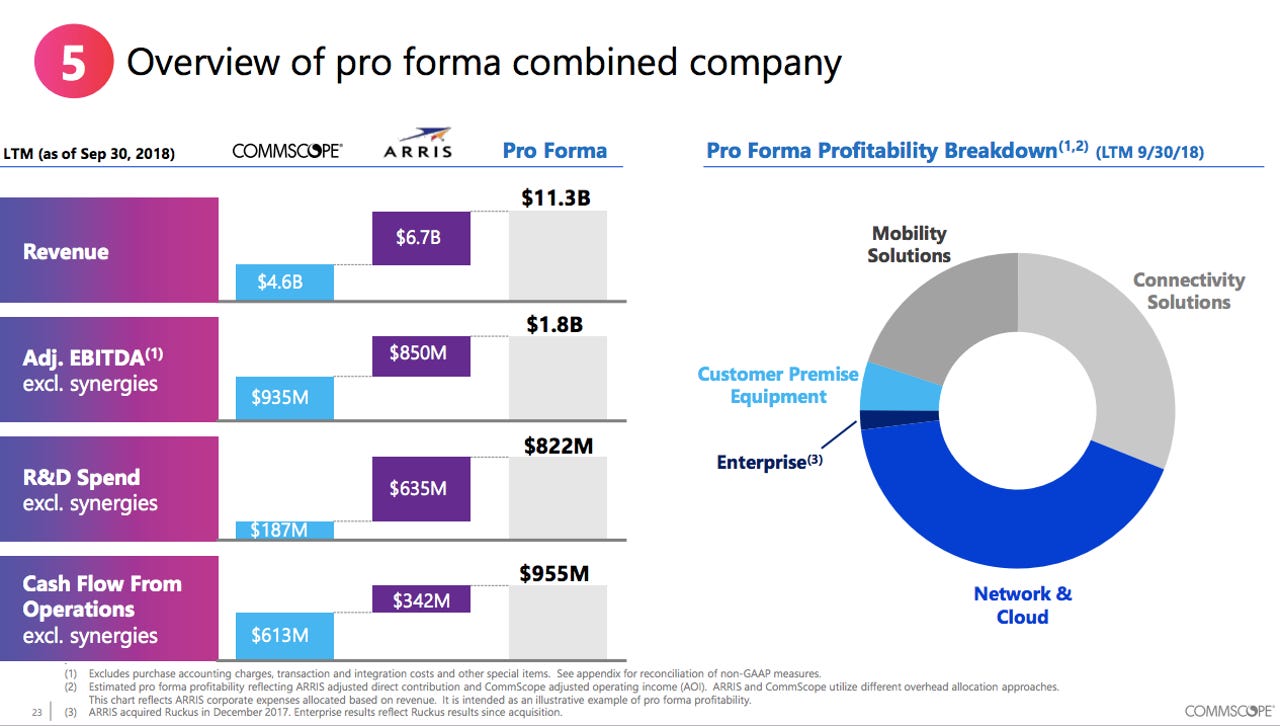

Combined, CommScope and ARRIS are hoping to capture market share in the burgeoning 5G, fiber and Internet of things markets, as well as other high-growth areas like private networks and connected homes. The companies expect to have combined revenue of approximately $11.3 billion and adjusted EBITDA of approximately $1.8 billion.

"For several years, we have watched quite closely as Ruckus has grown to become a strong leader in the market," said CommScope CEO Eddie Edwards, on a conference call with analysts. "The Ruckus team will be a critical and highly complementary addition to CommScope."

TechRepublic: A guide to tech and non-tech holiday gifts to buy online | Photos: Cool gifts for bosses to buy for employees | The do's and don'ts of giving holiday gifts to your coworkers

He continued:

"Our highly complementary offering, footprints, and customer relationships provide significant diversification and the transaction strengthens our positioning in the segments with the highest growth potential. The new spectrum being planned for 5G around the world being near, and now we expect a greater amount of wireless connectivity infrastructure to be needed indoors utilizing both licensed and unlicensed technologies, which the combined company will now have."

Best gifts for co-workers under $50 on Amazon

Black Friday 2018 deals:

- Black Friday 2018 and Cyber Monday 2018: When and where to get the best deals

- Walmart Black Friday ad features $99 Chromebook, $89 Windows 2-in-1 laptop

- BJs Wholesale Black Friday ad leaks with laptop, desktop, tablet deals

- Target Black Friday ad includes $250 iPad mini 4, $120 Chromebook deals

- Costco kicks off Black Friday ad leaks season with $250 iPad, pair of $200 laptops

- Amazon Black Friday 2018: See early deals on Echo, Fire HD, and more

- Dell Black Friday ad features $120 Inspiron laptop, $500 gaming desktop

PREVIOUS AND RELATED COVERAGE:

Verizon reorganizes into 3 groups to leverage 5G

Verizon will have three units--consumer, business and media--and the business division may see the most growth due to telematics, IoT, edge computing and 5G enterprise applications.

Sprint deploys gigabit LTE in 225 cities

Ahead of its 5G launch in nine areas in 2019 and its proposed merger with T-Mobile, Sprint has deployed gigabit-speed LTE in 225 cities across the US.

IBM partners with Seagate to put hard drives on the blockchain

The companies are aiming to build a system that addresses counterfeit hard drives and helps ensure hard drive compliance and security.